Cobalt Shortages Ahead

/in News /by cobalticGrowth in electric vehicles and batteries is causing supply issues that could affect broad swaths of the electronics market.

Rapid growth of electric vehicles is creating an enormous demand for cobalt, causing tight supply, high prices and supply chain issues for this critical material.

Cobalt is a ferromagnetic metal and one of the key materials used in lithium-ion batteries for cell phones, notebook PCs, battery-electric cars and hybrids. It also is used in alloys and semiconductors. And while the IC industry consumes a tiny percentage of the world’s cobalt supply, that supply is tightening.

For cobalt, the big growth market is the electric car business, which requires tons of cobalt a year. In the supply chain, metals are mined and processed into cobalt. Refined cobalt is sold to lithium-ion battery makers, which then sells rechargeable batteries to electric car makers like BMW, Nissan, Tesla, Toyota and others. A smartphone contains 5 to 20 grams of cobalt, compared to 4,000 to 30,000 grams, or 9 to 66 pounds, of cobalt per vehicle, according to Fortune Minerals.

Cobalt provides high energy density and thermal stability in a battery. Lithium-ion batteries consist of an anode, cathode and other components. Graphite is used for the anode. In one example of the cathode, Tesla uses a nickel-cobalt-aluminum-oxide (NCA) chemistry. In simple terms, lithium ions move from the anode to the cathode and back, causing the battery to charge or discharge.

All battery materials have an assortment of supply chain issues, but cobalt is arguably the biggest concern. For some time, cobalt supply has been tight and prices have skyrocketed as a growing number of carmakers are introducing and shipping the next wave of electric vehicles. China, for one, is making a major push into the arena.

Today, there is just enough cobalt produced to meet demand for electric cars, but it might be a different story in the future. “Generally speaking, there should be enough refined supply to meet demand over the next few years if capacity expansions continue, as expected,” said Jack Bedder, an analyst at Roskill, a metals/minerals research firm. “After around 2022, we will need to see much more capacity expansion if supply is to meet demand.”

The problem is that some 67% of the world’s cobalt supply is mined in the Democratic Republic of the Congo (DRC), a politically unstable nation with questionable business practices. “Many end-users, namely car companies, will need a lot of cobalt, perhaps thousands of tons each year to make their products,” Bedder said. “Cobalt demand is increasing and there are concerns about the availability of future mine supply. There are real child labor issues in the DRC, and thus responsible end users want to procure ethically sourced material.”

All told, the issues with cobalt are worrisome, causing the industry to react on several fronts. Among them are:

- A growing number of new cobalt mining projects are in the works, many of which are in nations outside the DRC.

- The industry is currently shipping lithium-ion cells with less cobalt due to cost and supply-chain concerns, but there are some safety issues on the horizon.

- Carmakers are forming new alliances with battery makers to secure a source of lithium-ion batteries, including cobalt. Last year, Panasonic, the battery supplier for Tesla, formed a battery partnership with Toyota. Recently, Volkswagen committed $25 billion in battery orders from three vendors—LG, Samsung and CATL. And not long ago, BMW signed a $4.7 billion battery deal with CATL.

Cobalt supply issues

There are a number of other alliances as well, meaning the electric car industry will require more cobalt to meet future demand. That’s even true if the amount of cobalt is reduced in the battery.

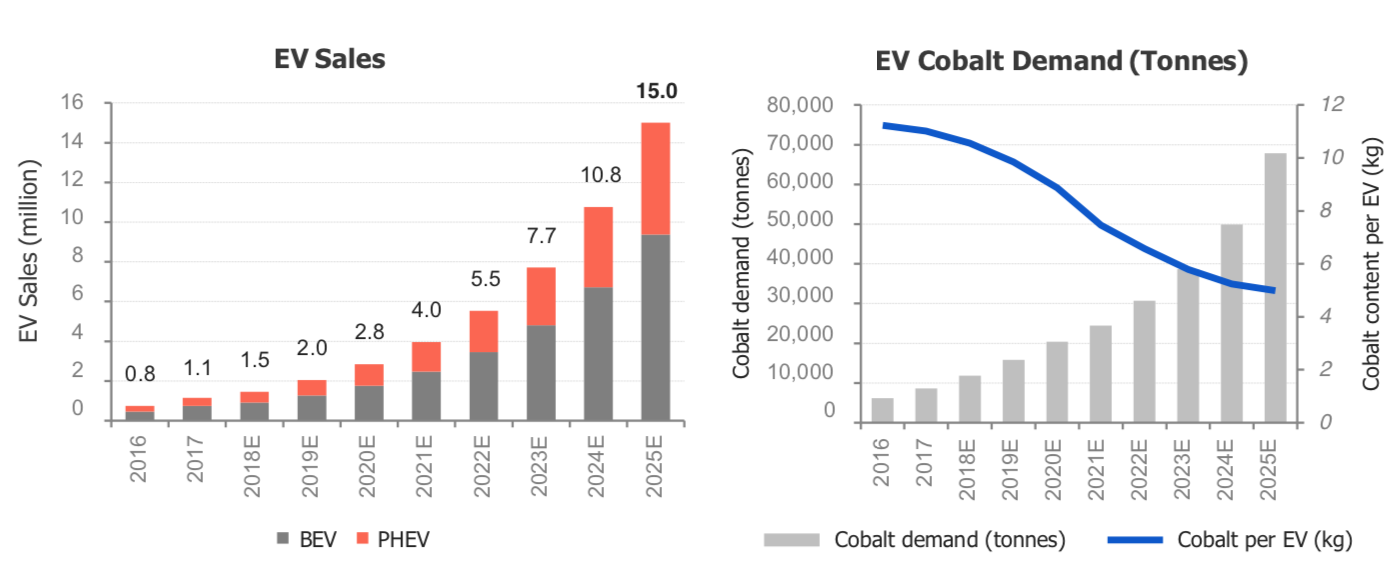

Fig. 1: EV Sales and Cobalt Demand Forecast Source: Cobalt27

In total, electric vehicles, including battery-electric cars and hybrids, represent about 1% of the world’s cars sold today. But driven by China and others, the electric vehicle market is projected to grow from 1.2 million units in 2017, to 1.6 million in 2018, to 2 million in 2019, according to Frost & Sullivan.

“Electric vehicles are taking off. Today, we are on track for 100 million passenger vehicles by 2020. That number is growing at around 3%,” said Mike Rosa, director of strategy and technical marketing for Applied Materials. “Of that number, there will be maybe 5 million that will be electric. That’s growing at about 4.6%.”

By 2025, the electric car market is expected to reach 25 million units, according to Frost & Sullivan. Other projections aren’t so rosy, as Cobalt27 projects 15 million units by then.

Regardless, the industry faces some challenges, which could hamper the growth rates. Battery technology and the charging infrastructure are among the challenges. Energy density, the amount of energy the battery can store, is one of the issues.

“The energy density of the Li-ion battery has nearly quadrupled in its 27 years of existence on the market through evolutionary improvements in materials and design,” said Philippe Vereecken, principal scientist and program manager at Imec. “The energy density of Li-ion batteries can currently provide a limited driving range of 400-500 km, whereas the consumer wants a driving range of 700 km or more. Also, the high cost of Li-ion batteries makes the electric car quite expensive.”

There are other issues. “In general, one of the challenges is that traditional lithium-ion is reaching its practical limits,” said Erik Terjesen, senior director of licensing and strategy at Ionic Materials, a startup that is developing a polymer electrolyte material for solid-state batteries.

“And as EVs are becoming more mainstream, there are increasing concerns about safety,” Terjesen said. “It’s well known that lithium-ion does contain flammable liquid electrolytes today. The automakers, in particular, realize the volume of batteries that they are going to consume. Given the fact that these cars are going to be on the road, they are thinking about safety.”

Safety is a concern in other respects. “We have high-end cars that have a lot of attributes, but one of the main things is safety,” said Rich Rice, senior vice president of business development at ASE, at a recent event. “We have electric cars and hybrids that have a lot of new requirements with extended temperature ranges and power delivery.”

While OEMs face an assortment of technical challenges, there are also supply chain issues behind the scenes, namely with cobalt. Cobalt itself resides in the Earth’s crust and ocean floor, but it isn’t mined in its pure form.

“Cobalt is a by-product of both copper and nickel. Not every copper deposit contains cobalt and not every nickel deposit contains cobalt,” explained Robin Goad, president and chief executive of Canada’s Fortune Minerals, a development stage mining company. Fortune is developing a cobalt-gold-bismuth-copper mining and refinery project in Canada.

“The primary by-product of copper production comes from a unique style of material deposits that are found in the east African copper belt. This goes up from Zambia through the Congo and up into Uganda,” Goad said.

Nickel deposits are found in Australia, Cuba, Canada and other nations. “Most nickel nickel sulfide and laterite deposits do contain cobalt as a by-product,” he said.

Generally, copper and nickel mining are capital-intensive businesses. Mining these metals and then refining them into cobalt isn’t new, but it’s a complex process with various challenges.

The supply chain is also problematic. DRC is the world’s largest cobalt producer, and the DRC government recently increased the royalties on mined products, such as copper, cobalt and gold, from 2% to 3.5%, according to Roskill. The royalties on cobalt could hit 10%. Some mining companies are exempt from the royalties for 10 years, however.

It’s unclear how this will impact pricing. Generally, cobalt prices have surged amid booming demand. Prices hovered around $13 per pound between 2012 and 2016, according to Roskill. But prices jumped to $32 per pound last year and were more than $42 per pound in early 2018, according to the firm.

The supply/demand picture is also a worrisome issue for OEMs. Today, several DRC-based cobalt mining projects are ramping up or have restarted to meet demand. The two most notable examples are mines operated by the Eurasian Resources Group and Katanga Mining. Glencore, the world’s largest cobalt mining company, has a major stake in Katanga.

In 2017, the worldwide supply of refined cobalt production reached 114,700 tons, while demand was at 117,700 tons, according to Roskill. “The market is broadly in balance,” Roskill’s Bedder said. “Again, we forecast that there will be sufficient levels of cobalt mine supply until around 2022, but thereafter we will need to see substantial increases.”

Here’s another way to look at the picture: In 2017, electric vehicles consumed about 9% of the world’s production of cobalt, 15.6% of lithium, 1.3% of nickel and less than 1% of manganese, according to the U.S. Department of Energy (DOE). The DOE projects that lithium-ion batteries “will dominate the total cobalt and lithium markets in a few years.”

To meet cobalt demand, the mining industry is developing a number of new projects. In fact, there are roughly 185 cobalt mining projects on the drawing board, according to Roskill. But many projects are still in the development phase, and may not move into production anytime soon.

“These are mines that could theoretically enter production. Most are at very early stages. Lots of projects are taking advantage of the recent hype around cobalt and EVs,” Roskill’s Bedder said. “For now, it’s important to focus on the more developed projects, while keeping an eye on the various early-stage projects to see how they progress.”

Meanwhile, once the metals are mined and processed, cobalt is refined. The materials are shipped to refining companies, many of which are in China. In fact, China controls 60% of the world’s cobalt refinery business.

All told, OEMs face several challenges. Procuring cobalt is a complicated process with several twists and turns. “You have complex supply chains. These are quite complex issues,” said Michèle Brülhart, director of innovations for the Responsible Business Alliance (RBA), a non-profit group that focuses on global electronics supply chain issues. The RBA has more than 125 members in the automotive, fab equipment, retail and semiconductor sectors.

“The risks that are being reported on or raised in the materials supply chain are concentrated at the very end of the supply chain, mostly what we call the upstream. This is where the materials are extracted, where the first processing takes place, and where they are exported and find their way into the international value chain,” Brülhart said.

The RBA spearheads several programs, including the Responsible Minerals Initiative (RMI), which addresses issues related to the responsible sourcing of minerals.

To help navigate the supply chain and develop best practices, RMI recently released the Risk Readiness Assessment Platform (RRA), a self-assessment tool that addresses risk management practices across 31 issue areas. It also lists downstream and upstream companies involved in tin, tungsten, tantalum, gold and cobalt. Tantalum, tin, tungsten and gold are considered conflict minerals, which by definition are extracted in conflict zones.

RMI also recently launched the Cobalt Reporting Template (CRT). “This is essentially a mapping tool. It allows companies to identify what we call choke points in the supply chain,” Brülhart said.

Battery trends

Once cobalt is refined, it is shipped to battery makers. For electric vehicles, the largest lithium-ion battery makers include companies such as BYD, CATL, LG, Panasonic, Samsung, SK and Tesla.

In total, there are 41 lithium-ion battery mega-factories in production or under construction worldwide, according to Fortune Minerals. Each plant requires tons of cobalt. For example, CATL is building a new facility that requires up to 23,000 tons of cobalt per year, analysts said.

Generally, there are several types of lithium-ion batteries. For example, batteries which are based on a lithium-cobalt-oxide (LCO) cathode chemistry are used in cellular phones and notebooks. Electric vehicle makers are using different types of lithium-ion cathode technologies, namely nickel-manganese-cobalt-oxide (NMC) and nickel-cobalt-aluminum-oxide (NCA). Tesla is in the NCA camp, while others use NMC.

The first round of NMC batteries contain equal concentrations of nickel, cobalt and manganese, which is referred to as NMC111. At one time, NCA batteries had a similar ratio.

In an NMC111 cell, the cathode material represents 40% of the cost of the battery, according to Benchmark Mineral Intelligence, a research firm. “So, there is an initiative to reduce the amount of cobalt contained in the batteries because of cost and supply chain concerns,” Fortune Minerals’ Goad said.

So NMC battery makers are now developing and shipping products with less cobalt. In these batteries, the nickel, cobalt and manganese content come in ratios of either 5:2:3 or 6:2:2. Most call it NMC532 (5 parts nickel, 3 parts manganese and 2 parts cobalt).

Generally, this reduces the cobalt by 20%, according to Benchmark, but it also increases the nickel content. Nickel helps to boost the energy densities in batteries.

This, in turn, impacts lithium-ion battery costs. “The cost is coming down because of the economies of scale. But more importantly, the batteries are delivering more power with less material. So you are getting more efficient batteries,” Goad said.

The industry is taking this a step further. Now it’s developing batteries with a cathode chemistry ratio of 8:1:1. Due out in 2019, the 8:1:1 batteries reduce the cobalt content and the associated costs. But the 8:1:1 batteries also face some challenges. As you move to a lower cobalt cell, the volatility increases and the probability of a flammable event is greater.

“The energy density is superior with greater nickel concentrations. But you do so at the expense of safety and there are some charging issues. The performance is impacted with lower cobalt,” Goad said. “You cannot eliminate cobalt below 5% or the structure of the lithium-ion battery breaks down. All of the major battery manufacturers will tell you that cobalt is going to be part of the chemistry for batteries at least for the next decade, if not two decades.”

Even with a lower cobalt content in batteries, the market will still require about 240,000 tons of cobalt per year by 2025, according to Exane BNP Paribas.

What’s next?

Regardless, the battery still remains the stumbling block for electric vehicles. They lack enough range to satisfy many consumers, particularly outside of urban areas.

This is the challenge being addressed by next-generation battery technologies. Some have little or no cobalt content, such as lithium-manganese-nickel-oxide (LMNO). Also in R&D are solid-state batteries.

A battery consists of an anode, cathode, electrolytes and a separator. The electrolytes are liquids that transport the ions from the anode to the cathode through a separator. “The separator keeps the anode and cathode from touching each other. It they touch each other, there is a short,” Ionic Materials’ Terjesen said.

Solid-state batteries replace the liquid electrolyte and separator with a solid material. This technology “will compact the materials in the cell and increase the cell voltage, both leading to an increase in the energy density,” Imec’s Vereecken said.

There are several efforts in the solid-state battery arena. Ionics, for example, has developed a polymer material that replaces the liquid electrolyte in the battery. A battery maker would still require an anode and cathode, both based on various chemistries.

Imec, meanwhile, is developing a solid nanocomposite electrolyte. These technologies are promising, but they are not expected to appear until 2025.

Until then, the industry will continue to use traditional batteries. Battery makers will also reduce the use of cobalt. Even so, cobalt will continue to haunt the supply chain, at least for the foreseeable future.